Top 10 AI-Powered Personal Finance Apps to Manage Your Money in 2025

AI finance apps are transforming how you manage money, turning everyday spending into data-driven decisions. As personal finance enters 2025, consumers demand tools that do more than track; they want predictive insights, automated savings, and tailored investment ideas. From automated expense categorization to intelligent budgeting, these apps promise less guesswork and more clarity. In this guide, you’ll discover the top AI-powered personal finance apps for 2025, learn how to choose them, implement a stack that actually works, and start optimizing your budget, savings, and investments today.

## What You Need to Know About AI Finance Apps

AI finance apps bring machine learning, automation, and smart analytics to everyday money tasks. They’re not just digital ledgers; they’re personal finance assistants that learn from your spending, earning, and goals to offer actionable advice. The central promise is simple: more accurate budgeting, automated savings, and smarter investments with less manual work.

### Key Features to Look For in Money Management AI

– Automated expense tracking and smart categorization that improve with time

– Personalization engines that forecast spending and savings needs

– AI-driven savings nudges, debt-pay-off suggestions, and micro-investing options

– Robust security, privacy controls, and transparent data-sharing policies

### Common Pitfalls to Avoid with Budgeting Apps

– Over-reliance on automation without regular reviews

– Underestimating data-sharing permissions and privacy risks

– Selecting an app that doesn’t integrate with your bank or investment accounts

– Chasing flashy features while ignoring core budgeting discipline

When you pick the right mix, these tools turn data into decisive action: you see where your money goes, you save automatically toward goals, and you get investment ideas that fit your risk tolerance. The trick is balancing automation with deliberate human judgment—your inputs still matter, and your goals should drive every recommendation.

## Why AI Finance Apps Matter in 2025 and Beyond

The money-management landscape is shifting from manual tracking to proactive optimization. AI finance apps leverage pattern recognition, natural language interfaces, and predictive analytics to turn raw transaction data into meaningful steps toward financial goals. In 2025, these tools are increasingly essential for people balancing rising living costs, varying incomes, and the desire to automate savings without sacrificing lifestyle.

### Personalization at Scale

Modern AI tools tailor recommendations to your behavioral signals, not just your demographics. The result is budgeting that adapts to your salary changes, seasonal expenses, or irregular gig income. With smart forecasting, you’ll see when to adjust spending, how much to save, and which investments align with your goals.

### Security, Privacy, and Compliance

Security is non-negotiable. Reputable apps use bank-grade encryption, biometric authentication, and transparent data-sharing disclosures. They also stay current with regulatory standards and provide easy opt-out options. You can trust that your financial data is used to improve insights rather than mined indiscriminately.

### Money Management AI in Practice

Think of AI as your financial compass: it reads your cash flow, flags unnecessary subscriptions, suggests debt-payoff sequences, and recommends robo-advising tweaks for your portfolio. These tools excel when used consistently, paired with occasional human checks to ensure alignment with life goals and changing circumstances.

## Top 10 AI-Powered Personal Finance Apps for 2025: A Complete Guide

Here’s a concise tour of the most impactful AI-powered personal finance apps you should consider this year. Each entry highlights who it’s best for, its standout AI features, and the types of financial goals it supports.

1) Mint

– Best for comprehensive budgeting and expense tracking with smart insights.

– AI features: automatic categorization, trend detection, and personalized alerts to curb overspending.

– Ideal for: households looking for a free, all-in-one budgeting hub with investment tracking options.

2) YNAB (You Need A Budget)

– Best for proactive budgeting discipline and goal-driven spending.

– AI features: adaptive forecasting and spending guidance based on real-time income changes.

– Ideal for: those who want a hands-on budgeting framework with strong behavioral nudges.

3) Personal Capital

– Best for integrated budgeting and investment oversight.

– AI features: spending analytics, risk-based portfolio insights, and fee analysis to optimize returns.

– Ideal for: investors who want a clear link between daily money management and long-term goals.

4) Acorns

– Best for automated investing and micro-saving.

– AI features: recurring investment suggestions, round-up-based savings, and portfolio health checks.

– Ideal for: beginners who want a simple entry into robo-advising and hands-off growth.

5) Betterment

– Best for automated investing and retirement planning.

– AI features: tax-efficient optimization, goal-specific portfolios, and personalized advice.

– Ideal for: busy professionals seeking a hands-off path to growth with clear retirement planning.

6) Wealthfront

– Best for a comprehensive robo-advisor with financial planning tools.

– AI features: automated rebalancing, risk parity optimization, and goal-based projections.

– Ideal for: users who want a robust, low-maintenance investment strategy with planning capabilities.

7) Digit

– Best for automated savings and emergency fund growth.

– AI features: algorithmic savings based on spending patterns and future income estimates.

– Ideal for: anyone who struggles with saving consistently yet wants frictionless progress.

8) Albert

– Best for AI-powered financial coaching and proactive money management.

– AI features: spending insights, automated transfers, and tailored financial coaching tips.

– Ideal for: those who want a personal-finance coach without the cost of a human advisor.

9) Emma

– Best for intelligent budgeting and bill tracking with AI-driven insights.

– AI features: smart categorization, duplicate-bill detection, and proactive cash-flow guidance.

– Ideal for: users who want a clean interface and strong alerting to avoid late payments.

10) Cleo

– Best for conversational budgeting help and quick financial questions.

– AI features: chat-based budgeting tips, playful goal tracking, and quick savings nudges.

– Ideal for: users who prefer a chatbot-driven, interactive budgeting experience.

Each of these apps brings something unique to the table. Depending on your goals—tight budgeting, automated saving, or a hands-off investing approach—you can assemble a tailored stack. For many readers, pairing a budgeting-focused app (like Mint or YNAB) with a robo-advisor (Betterment or Wealthfront) creates a powerful, efficient money-management system that operates largely on autopilot while keeping you in the loop.

## Practical Use Cases: Turn AI Money Tools into Real Savings

To make these tools truly transformative, you need practical scenarios that translate to real results. Here are three real-world ways people use AI finance apps to improve money outcomes.

### Case Study 1: Automated Savings That Actually Sticks

You open Digit, set a modest monthly savings target, and let the algorithm handle transfers and round-ups. Over weeks, small amounts accumulate toward a sizeable emergency fund without you having to think about it. You also pair this with an AI-driven budgeting app that identifies recurring subscriptions you barely use. The result is effortless savings plus cleaner cash flow, giving you a safety net and a clearer picture of your monthly finances.

### Case Study 2: Smarter Budgeting for Irregular Income

If you’re a freelancer or gig worker, AI budgeting apps like Mint or Emma can adapt to fluctuating income. They forecast cash flow based on your past earnings and upcoming gigs, adjusting your budget categories accordingly. When a big client pays late, the app can automatically reallocate funds from discretionary categories to cover essential expenses, reducing stress and avoiding overdrafts.

### Case Study 3: Simplified Investing for Busy Professionals

Betterment or Wealthfront can take over the heavy lifting of investing. You set your risk tolerance and time horizon, and the robo-advisor handles diversification, tax optimization, and rebalancing. It’s a practical way to build long-term wealth without daily market monitoring. Pair this with a budgeting app to align your daily spending with your retirement plan, and you’ve created a comprehensive, hands-off financial system.

By using AI-driven tools in combination, you gain both macro perspective (your long-term goals) and micro visibility (every dollar you spend or save). The synergy is where people see meaningful shifts in financial health—less manual effort, more consistent progress, and clearer decision-making.

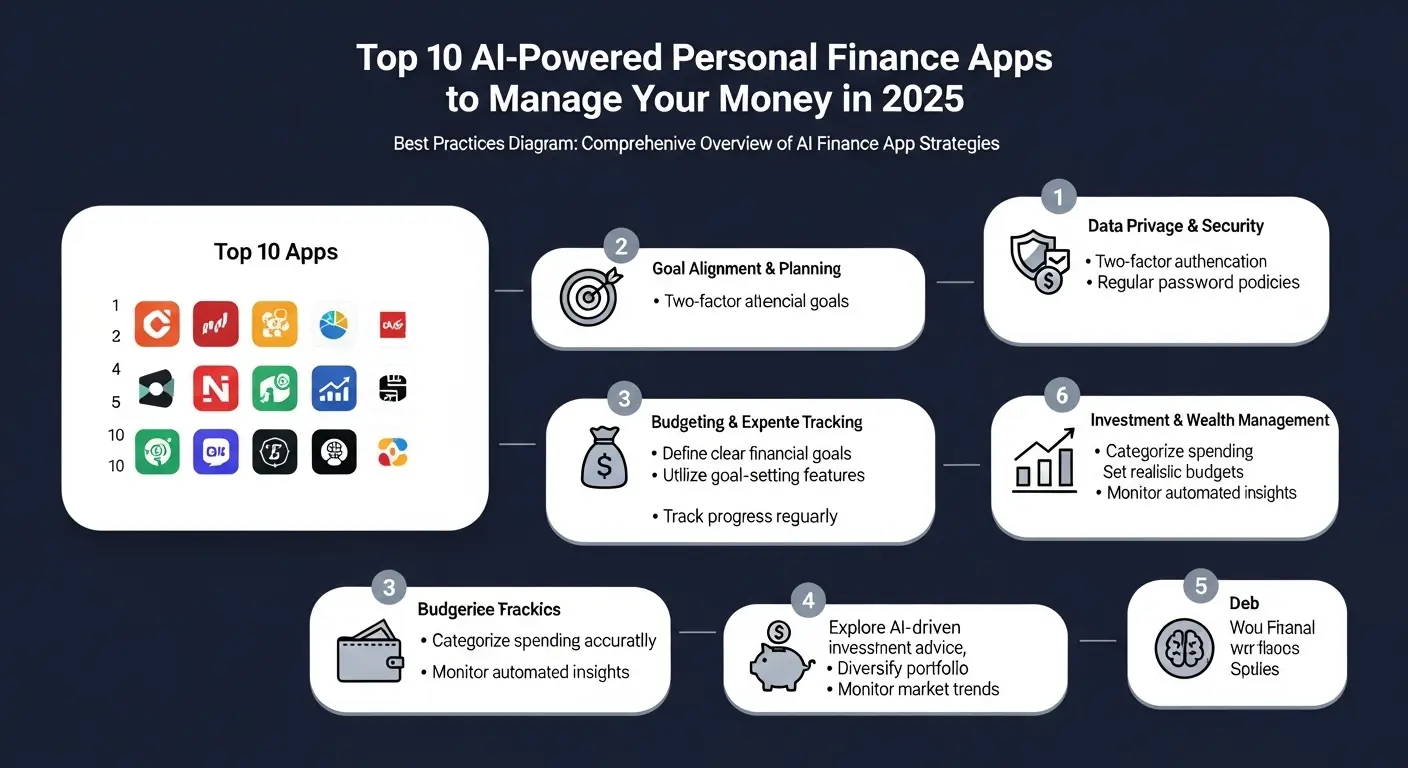

## How Do You Choose the Best AI Finance Apps in 2025?

Choosing the right AI finance apps comes down to aligning features with your goals, not chasing the newest buzzwords. Start by mapping your priorities: budgeting discipline, savings automation, debt payoff, or investing. Then evaluate each candidate app against a simple rubric.

### What to Consider When Selecting AI Finance Apps

– Integration and data harmony: Will the app connect with your bank, credit cards, and investment accounts?

– Personalization quality: Does the AI adapt to your income variability, goals, and spending patterns?

– Security and privacy: What encryption standards, authentication methods, and data-sharing controls exist?

– Pricing and value: Are premium features worth the cost based on your needs?

– User experience: Is the interface intuitive, and do you receive timely, actionable insights?

### A Quick Decision Framework

1. List your top 3 goals (e.g., save $X, automate debt payoff, begin investing).

2. Choose one budgeting app for daily tracking and another robo-advisor for investing.

3. Confirm data-access permissions and security features.

4. Test with a 30-day trial or free version to validate AI quality and usefulness.

5. Review progress weekly and adjust the stack as needed.

If you approach selection with intention, you’ll avoid overhauling your finances every few months. A stable, well-chosen AI toolkit pays off through steady savings, smarter spending, and improved investment decisions over the long term.

## Implementation: A 7-Day Setup Checklist to Kickstart Your AI Money Stack

Putting your AI-powered money tools to work quickly can be the difference between “nice-to-have” and “habits for life.” Use this 7-day plan to configure, test, and start realizing results.

1) Day 1 — Define goals

– Decide on 2–3 concrete outcomes (e.g., save $500 in 90 days, pay off a small debt, begin a starter investment).

– Note your timelines, risk tolerance, and preferred apps.

2) Day 2 — Pick your core apps

– Choose one budgeting-focused app and one investing or saving app that complement each other.

– Ensure both integrate with your bank accounts and have clear AI-driven features.

3) Day 3 — Connect accounts

– Link bank accounts, debit/credit cards, and any loan or investment accounts.

– Review permissions and privacy settings; enable alerting for unusual activity.

4) Day 4 — Establish baseline and goals

– Import past transactions, categorize expenses, and set initial budgets.

– Create savings goals and a target timeline for each.

5) Day 5 — Set automation rules

– Turn on automatic transfers, round-ups, or debt-payoff triggers.

– Define which expenses to cut or reallocate, using AI insights as guidance.

6) Day 6 — Monitor and adjust

– Review AI recommendations, tweak categories, and adjust goals as needed.

– Schedule a weekly check-in to stay aligned with your plan.

7) Day 7 — Review outcomes and expand

– Assess savings progress, budget adherence, and investment performance.

– Consider adding a second tool if your goals expand (e.g., a tax-optimization feature or a loan payoff module).

This structured approach helps you move from setup to tangible outcomes quickly, ensuring your AI tools stay aligned with your evolving financial life.

## Future Trends and Predictions in AI-Powered Personal Finance

The next wave of AI finance apps will likely emphasize deeper personalization, more proactive financial guidance, and stronger cross-device orchestration. Expect enhancements in natural language interfaces that let you ask questions like, “How should I adjust my budget given this month’s irregular income?” and receive clear, actionable plans. As APIs and data-sharing standards mature, expect smoother integrations with employer-provided benefits, tax tools, and even omnichannel experiences that let you interact with your finances via voice, chat, or a dashboard.

Security will continue to be a priority, with more transparent AI explanations about why a suggestion is made and what data it relied upon. Expect more tailored investment recommendations that factor in ESG considerations, life events, and changing risk tolerance. The combination of smarter automation and more thoughtful human oversight will empower you to stay on track toward long-term goals without sacrificing present-day flexibility.

## Conclusion: Your Next Step Toward Smarter Money Moves

In 2025, AI finance apps offer more than convenience—they deliver clarity, discipline, and scale for your money journey. By selecting a balanced combination of budgeting, saving, and investing tools, you can automate routine tasks, surface meaningful insights, and keep your financial goals within reach. Start by defining 2–3 personal objectives, pick one strong budgeting app and one robo-advisor that complement each other, and implement a 7-day setup plan to gain momentum fast.

What will you do this week to start using AI finance apps to their full potential? Share your plan in the comments, tag a friend who should consider upgrading their money management, or try a 30-day trial with your chosen tools to experience the transformation firsthand. Your future self will thank you for the deliberate steps you take today.

Featured Image ID: 5360

Category ID: 159

Slug: ai-powered-personal-finance-apps-2025

Excerpt: Discover the best AI-powered personal finance applications that help you budget, save, and invest smarter in 2025. From automated expense tracking to intelligent investment recommendations, these apps are revolutionizing money management.

Tags: AI finance apps,personal finance 2025,budgeting apps,money management AI,financial planning tools